Steel Market Insight March 2021

Steel Market Insight March 2021

As a passionate observer of economics and finance it is a pleasure to contribute to an ongoing quarterly newsletter column regarding historic, current, and future trend perspectives on various material and commodity inflationary and deflationary impacts on the building and infrastructure sectors on behalf of the Calgary Construction Association.

In this article, attention is specifically devoted to examining the use of steel in building and infrastructure projects. Starting with some facts drawn from the 2020 World Steel Organization and other sources, one begins to better appreciate the global big-picture and the inflationary risk pressures lying ahead.

Global Steel 2020 Statistics

- Global Steel production rose from 189Mt in 1950 to 1864Mt in 2020 and comes in 3,500 different grades.

- The top 5 producers are China (1,053Mt), India (99.6Mt), Japan (83.2Mt), Russia (73.4Mt) and USA (72.7Mt).

- Buildings & Infrastructure account for about 52% of steel used globally around the world.

- Application use is split with 44% in reinforcing bars, 31% in sheet products, 25% in structural sections.

- Steel is the most recycled material in the world and in construction recycling of steel is approaching 85%.

- Over 25 billion Tonnes of steel scrap have been recycled since 1990, almost 630 million tonnes annually.

- On average new steel products contain about 30% recycled steel without any compromise in quality.

- The average energy intensity per Mt of steel produced has dropped from 50 GJ/t in the 1960s to 20 GJ/t.

Current North American Economic Realities

According to a recently released analysis, the American iron and steel industry is a dynamic part of the U.S. economy, accounting for more than $520 billion in economic output and nearly two million jobs in 2017, when considering the direct, indirect (supplier) and induced impacts.

The Global Steel Trade Monitor May 2020 report shows that the United States accounted for the largest share of Canada’s imports by source country with 43% (2.9 mMt), with steel imports in flat, long, pipe and tube, followed by South Korea at 7 % (0.5 mMt), China at 5% (0.4 mMt), and Japan at 4% (0.3 mMt).

Canada was the world’s nineteenth-largest steel importer in 2019, importing 6.8 million metric tons of steel, a 24 % decrease from 8.9 million metric tons in 2018. Canada’s imports represented about 2 percent of all steel imported globally in 2019.

Canada imports steel from over 100 countries and territories. The ten countries and territories labeled in the map below represent Canada’s top sources of steel in 2019, each sending more than 150 thousand metric tons and together accounting for 5.4 million metric tons of steel or 78% of Canada’s total steel imports.

Within Canada the top five steel producers are as follows.

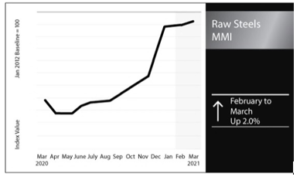

The recent 2020-2021 price spike in raw steels.

Future Competing Global Realities

Most of the increase in urban migration began approximately 200 years and is expected to reach 7 billion by 2050. The competing demand for steel throughout the world will likely increase exponentially as cities increase their vertical density construction and urban transit commuting routes, given the fact that only 4 billion people now currently live-in urban areas globally.

With the Biden Administration’s recent announcement of a $3 trillion stimulus spending plan, much of it directed to infrastructure to revitalize their country’s assets, the world’s second largest economic superpower, China, has been plowing ahead for years. In February, the Chinese government set out a 15-year plan for the country’s transportation network, pledging to boost the rail network from 146,300 kilometers (91,000 miles) in 2020 to about 200,000 kilometers by 2035 – and adding 162 new civilian airports.

Not to be overlooked, India is expected to become the world’s third largest construction market by 2022. Investment projections amounting to $1.5 trillion over the next five years in the energy, road, railway and pipeline sectors in the Indian economy will lead to additional global supply chain challenges and inflationary pressures.

The Financial Markets

To really understand the financial pressures on the supply and demand realities impacting steel pricing, it is necessary to look deeper into the picture. Wall Street commodity investors are back in full force with money managers bullish on bets especially on metals, energy and grains. Some economists and analysts suggest that the world might be approaching a supercycle tsunami of growth.

Commodities have experienced three other, comparable supercycles since the start of the 20th century. U.S. industrialization sparked the first in the early 1900s, global rearmament fueled another in the 1930s and the reindustrialization and reconstruction of Europe and Japan following World War II and, more recently, China’s rise to economic heavyweight status beginning in the early 2000s.

Take Away Thoughts

Any number of unforeseen black swan occurrences, from a fiscal crisis brought on by speculation in bitcoin, an ongoing devaluation of the US dollar, western government central banking “red capitalist” intervention, to the recent Texas ice storm in 2021, could trigger upward marketplace global pressures on raw steel.

The CERI Commodity Report indicates a strong, statistically significant, positive relationship between WTI crude prices and steel prices, with every $1 increase in the WTI price adding approximately $6.58 per tonne.

My bet, having been through the immediate short-term downward pressure effects of the Covid-19 crisis on the Canadian and global economy, is that steel price pressures are likely to explode in the short-term as more financial speculation pressures increase in the next 2 years, level off briefly and then rise significantly after 2025 when the real stimulus global spending demand for steel takes off against a very limited supply capacity.

Transportation, urban infrastructure, and high-rise projects take time to engineer and design properly. Capacity to increase supply and bring on new steel production facilities combined with the added emphasis on more Environmental, Social and Governance (ESG) accountability hurdles, imposed the world over by organizations such as World Bank, the Canadian Infrastructure Bank, and the various sovereign funds such as the Norwegian Wealth Fund, will lead to production supply bottlenecks and surging inflationary steel pressures.

For public sector owners contemplating the next 30 years, infrastructure investment, like a house mortgage properly financed in the current low interest market, is very attractive and appealing. For Contractors and Subcontractors exposed to the rampant steel material price risk fluctuations through extended procurement and execution timelines, cultivating healthy supplier relationships and paying attention to the bigger picture each business quarter is advisable.

KGC Consulting Services Ltd. thanks the Calgary Construction Association for the privilege of authoring this article. In the next quarterly publication, we will examine the history and current economics of concrete.

References

- World Steel Association worldsteel.org

- Metal Miner, agmetalminer.com

- Bloomberg, bloomberg.com/new/articles/2019-12-31/india

- Global Steel Trade Monitor Report May 2020

- India Brand Equity Foundation, ibef.org

- Bloomberg, bloomberg.com/news/articles/2021-03-22

- Our World In Data Org., ourworldindata.org/urbanization

- CERI Commodity Report – September 2011

Jerry Crawford is a claim consulting professional and a registered CIQS designation holder, and holds a PMP designation from the Project Management Institute. He is also Gold Seal Certified with the Canadian Construction Association.

Jerry has over 40 years of construction industry experience, both nationally and internationally. He is the founder and principal director of KGC Consulting Services Ltd. and works with clients to provide construction dispute litigation support on transportation, energy, commercial, industrial, multi-family residential, civil and building infrastructure projects.